Factors that determine hourly rates

The billing rate is influenced by four factors:

- Whether the time entry is billable or non-billable

- The role selected for the labor entry, which has an associated billing rate

- The billing contract

- Rate adjustments configured for the work type

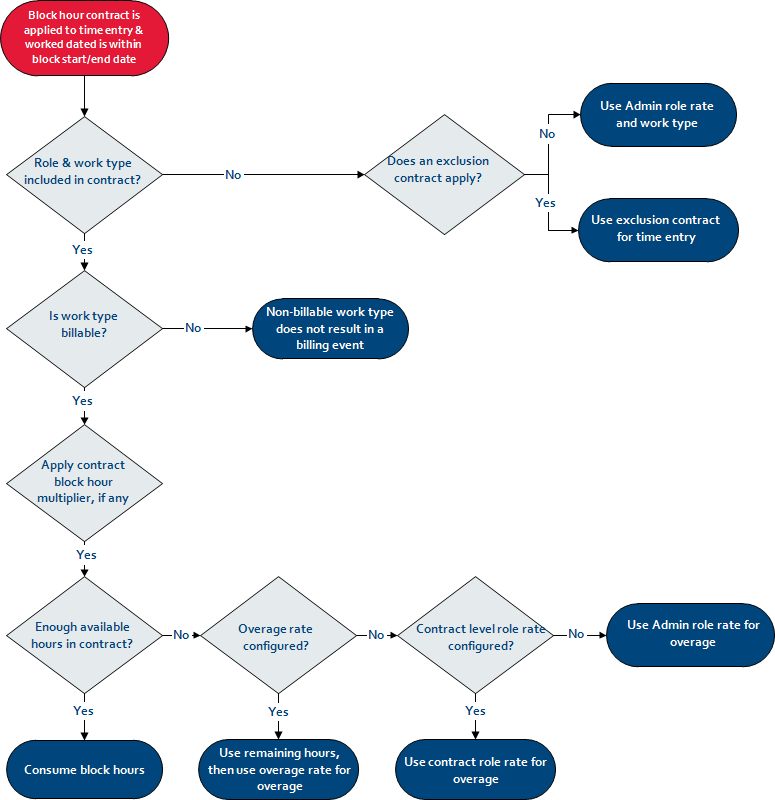

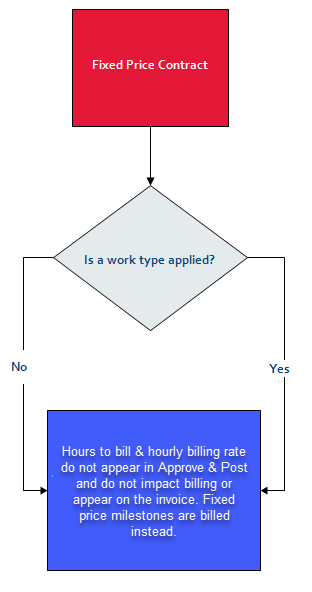

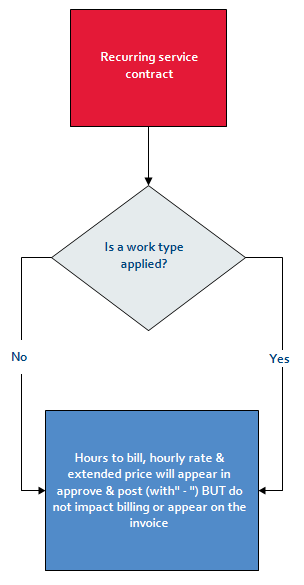

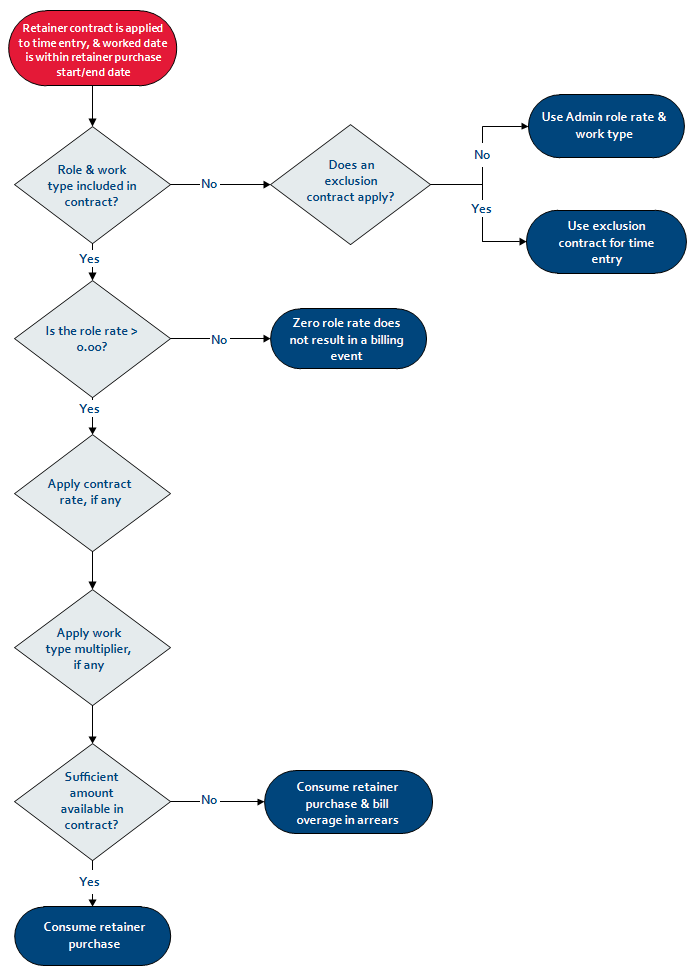

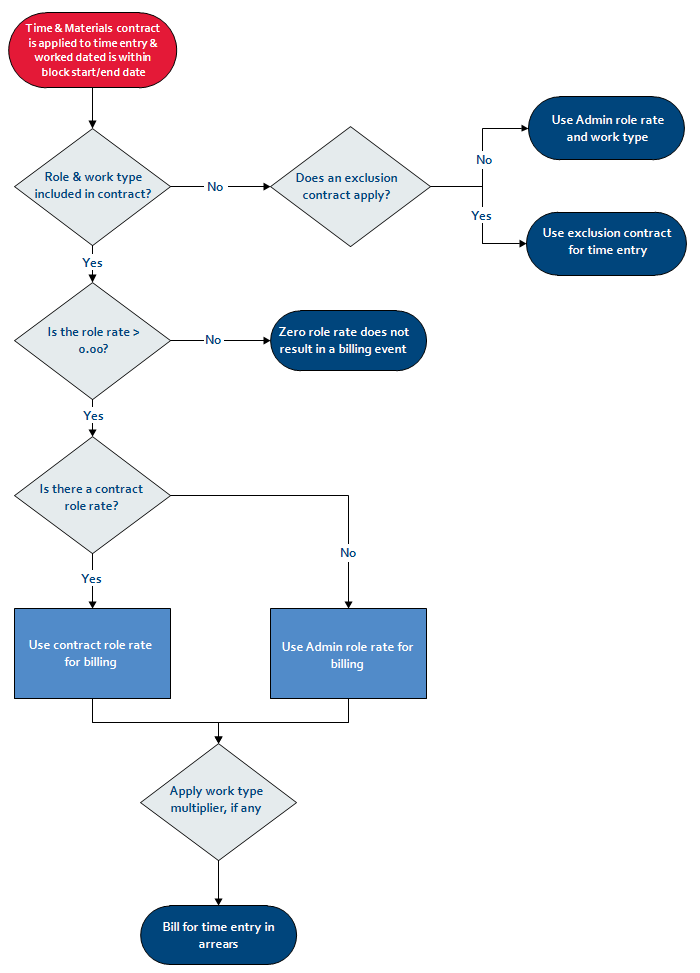

How the contract type determines billing workflows

The rate is determined as follows:

| No Contract | T&M Contract | Fixed Price Contract | Block Hour Contract | Retainer Contract | Recurring Services Contract | |

|---|---|---|---|---|---|---|

| Non-billable Work Type | Hourly Billing Rate = 0.00 | Hourly Billing Rate = 0.00 | Transaction is in folder "Approve and Post Labor" but is non-billable | Hourly Billing rate shows dash (-); No time is deducted from Block | Hourly Billing Rate = 0.00; no money is deducted from Retainer Purchase | Hourly Billing Rate shows dash (-) |

| Billable Time Entry | Default role rate is applied | Contract Role rate is applied. | Transaction is in folder "Approve and Post Labor" but is non-billable | Hourly Billing rate shows dash (-); Hours to bill are deducted from available Block according to block hour multipliers | Contract Role rate is applied; money is deducted from available Retainer Purchase according to contract rate | Hourly Billing rate shows dash (-) |

| Work Type Rate Adjustment | Work type role rate adjustment is applied to default role rate | Work type role rate adjustment is applied to contract role rate. Adjusted rate is applied. | Transaction is in folder "Approve and Post Labor" but is non-billable | Hourly Billing rate shows dash (-); Hours to bill are deducted from available Block according to block hour multipliers. Block hour multipliers compound work type rate adjustment. For example, Hours to Bill * Contract Block Hour Multiplier or Admin Role block hour multiplier * Multiplier. | Work type role rate adjustment is applied to contract role rate. Adjusted rate is applied; money is deducted from available Retainer Purchase according to adjusted contract rate. | Hourly Billing rate shows dash (-) |