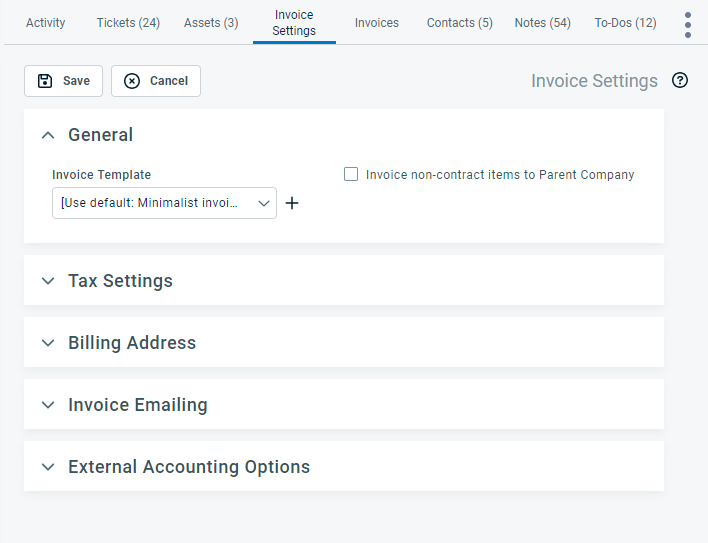

The Invoice settings tab and page

PERMISSIONS Security level with access to Contracts, and account managers and account team members if the Allow Account Managers and Account Team Members to access the Organization page’s Financial View for their accounts, even if they do not have access to the Contracts module is enabled.

NAVIGATION Left Navigation Menu > CRM > Search > Organizations > click Search > click an organization name > accessory tabs > Invoice Settings

NAVIGATION Left Navigation Menu > Contracts > Invoicing / Items to Invoice > context menu > View/Edit > Organization Invoice Settings

The Invoice Settings tab where you can customize billing settings for an individual organization appears on the accessory tabs of the Organization page. It displays the same fields as the Invoice Settings page associated with the organization. These settings will be used when you generate invoices using the batch invoicing process, and will be the defaults when you generate a single invoice. To open the page, use the path(s) in the Security and navigation section above.

NOTE Many default invoice settings can be changed during the invoicing process. Refer to Processing invoices.

To configure invoice settings, complete the following fields:

| Field | Description |

|---|---|

General |

|

| Invoice Template |

This field appears on pages where the invoice template can be selected. An invoice template allows you to define the layout and style elements, data fields, and grouping and sorting options on your invoices. Refer to The Invoice settings tab and page. Select an active invoice template for processing this batch of invoices, or a default invoice template for an organization or a country. The selection you make here will override any setting at the system, country, or organization level. |

| Invoice non-contract Items to Parent Organization | Select this check box if you would like billable items that are not associated with a parent or sub-organization contract to always be invoiced to the parent organization. When this check box is selected, billable items will appear under the parent organization, not the sub-organization, on the Invoicing / Items to Invoice page. Refer to Invoicing sub-organization items to a parent organization. NOTE If the parent/sub-organization relationship is terminated, any non-posted billing items without a contract will appear under the sub-organization on the Invoicing / Items to Invoice page. |

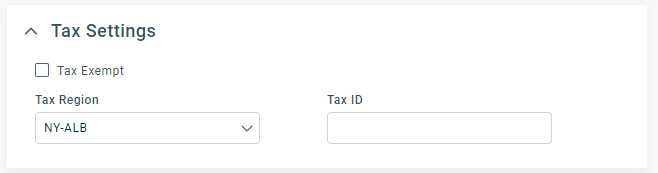

| Tax Settings These settings can also be managed on the Organization pages.  |

|

| Tax-Exempt |

Tax-exempt items invoiced to this organization will not be taxed, regardless of the tax category applied to the billing item. You can override theTax Exempt setting for an organization location. NOTE For QuickBooks Users: The Tax-exempt status flag is transferred to QuickBooks with a new customer. If the Tax Exempt setting is overridden at the organization location level, this is disregarded in QuickBooks, because a location is not a separate customer. |

| Tax Region |

Select the tax jurisdiction whose tax rules will apply to this organization or organization location. This field is inherited by entities that are part of the billing workflow but can be overridden on a quote or invoice. The tax region selected on the quote or invoice, together with the tax category applied to the billing items via the billing codes, determine the taxes on each billing item. Refer to Configuring your tax table. NOTE For QuickBooks users: The Tax Region is transferred to QuickBooks. If the Tax Region setting is overridden at the organization location level, this is disregarded in QuickBooks, because a location is not a separate customer. |

| Tax ID |

The tax identification number for this organization.

|

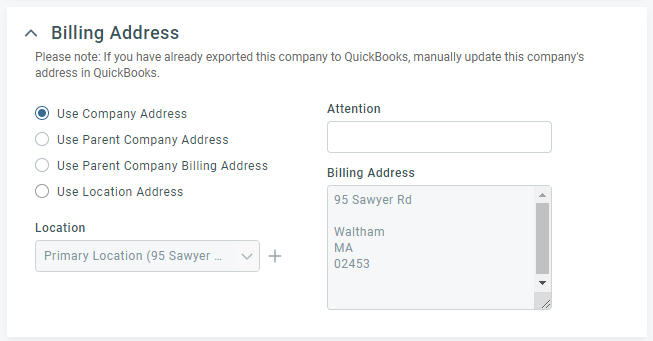

Billing Address |

|

| Use Organization Address | When this is selected, the Billing Address area of the invoice will include the organization address as listed on the Organization page (CRM > Organizations > find organization > Organization page). |

| Use Parent Organization Address | Applies to Sub-organizations Only:

Select this option when you would like the invoice Billing Address to include the parent organization address as listed on the Organization page (CRM > Organizations > find organization > Organization page). Select this option if the invoice is always sent to the parent organization's regular address. |

| Use Parent Organization Billing Address | Applies to Sub-organizations Only: Select this option when you would like the Billing Address area of the invoice to include the parent organization address as listed on the Invoice Settings page in Financials (CRM > Organizations > find organization > Organization page > Financials tab > Invoice Settings). Select this option if the invoice is always sent to the parent organization's billing address. TIP If you select one of the parent organization addresses for a sub-organization's invoice, the sub-organization name will still appear on the first line of the mailing address. If the parent organization has an entirely different name, you can use the Enter Address Manually option instead and add the parent organization name in the Attention line to clarify. |

| Use Location Address | Select this option when you would like the invoice Billing Address to display the address of an organization location. Select the appropriate location from the data selector, or click + to add a new location. |

| Attention | Enter a name to address the invoice to a particular person. |

| Billing Address |

This view-only field is populated with the information for the address option selected (i.e., organization, parent organization, parent organization billing address, or a manually entered address). Note for Users who Invoice in Other Accounting Packages: This information will |

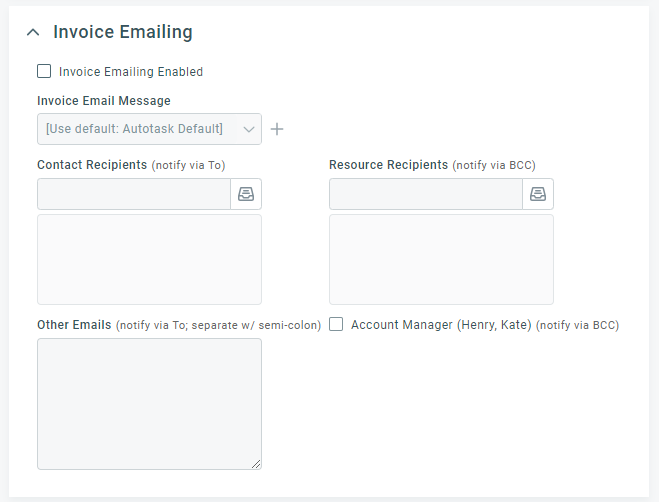

Invoice Emailing |

|

| Invoice Emailing Enabled | Select this check box to enable the emailing of invoices to this organization. |

| Invoice Email Message | Select the email template to attach the invoice to, or create a new one. Refer to Adding or editing email message templates for invoices or quotes. |

| Contact Recipients (Notify via To) |

The contact recipient is the customer contact to whom the invoice is emailed. Select or enter the customer contacts to whom you would like to send the invoice email when invoices are processed.

|

| Resource Recipients (Notify via BCC) |

The resource recipient is the internal user to whom the invoice is emailed. Select or enter the user name to whom you would like to send the invoice email when invoices are processed

NOTE You can also set the CC: and BCC: fields in the Invoice Email Message, which is configured by your Autotask Administrator. Autotask combines recipient settings from both fields and then removes duplicates. Refer to Adding or editing email message templates for invoices or quotes. |

| Other Email(s) | Enter recipients whose email addresses are not found in Autotask. Separate addresses with a semi-colon. |

| Account Manager (notify via BCC) | Select this check box to send a copy of each invoice to the account manager via blind carbon copy. |

External Accounting Options |

|

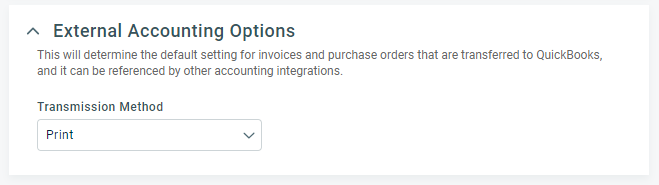

| External Accounting Options |

Select how the invoice will be transmitted to the customer. The value you select here is included in the billing data export and can be referenced by external accounting integrations. This field may be populated with the default setting selected in the QuickBooks Invoice Method (refer to System settings that impact QuickBooks users). The following options are available:

|

e-Invoicing |

|

|

Disable e-invoicing for this organization |

If e-invoicing is enabled globally, select this check box to disable e-invoicing for this organization. For more information regarding global settings and how to disable globally, refer to e-Invoicing. |

|

e-Invoice Email Message |

Select the email template to attach the invoice to, or create a new one. Refer to Adding or editing email message templates for invoices or quotes. |

|

Use Account Billing Contact Email |

Select this check box to email the invoice to the Main Billing Contact of the organization. NOTE This option cannot be enabled unless the organization has a designated Main Billing Contact. Refer to Main Billing Contact for more information. |

|

Alternate Fallback Email |

Enter the email address to receive invoices when no Main Billing Contact is assigned. |

|

Invoice Destination Country |

The listed country of the organization's address is displayed. |

|

Requires government invoice. |

Select this checkbox if the organization is required to submit invoices through a government-mandated e-invoicing process. When enabled, Autotask will treat all invoices for the organization as requiring submission to the appropriate government or tax authority via the designated e-invoicing network (e.g., PEPPOL or a country-specific system). |

|

Use Organization Tax ID |

This check box is selected by default and the Tax ID of the organization is used. IMPORTANT When e-Invoicing is enabled, the organization must have a Tax ID. Refer to Adding an organization. |

|

Legal ID |

A business registration ID that is unique to the organization. This ID may be required in addition to the Tax/VAT ID or be the same. Whether this ID is required is determined by the local government. |