Calculating taxes in Autotask instead of QuickBooks? (US versions only)

PERMISSIONS Admin access to the QuickBooks data file and security level with permission to configure the QuickBooks Extension. Refer to Admin security settings.

NAVIGATION Left Navigation Menu > Admin > Admin Categories > Extensions & Integrations > QuickBooks Extension > Web Connectors > Edit a web connector

Why calculate taxes in Autotask?

IMPORTANT For the record, we strongly advise against doing this for new customers. We continue to make this feature available to support a number of legacy customers who depend on this workflow.

Users of the US version of QuickBooks (QB) have the option of transferring the taxes calculated in Autotask to QB. Autotask differs from QB in the way it calculates taxes.

We generally recommend that QB users calculate the taxes on the transferred invoices in QB, because tax items are already set up in QB and you don't want to duplicate the effort in Autotask.

However, there are certain circumstances when calculating taxes in Autotask would make sense:

- Your customers use the Client Portal and are able to retrieve the Autotask invoices from there. You need to calculate taxes on the invoice and want to make sure that the tax amounts in Autotask and QB, where you handle your Receivables, are exactly the same.

- Your organizations have multiple locations and tax nexuses, and you use TaxJar to calculate sales tax. Refer to The TaxJar integration.

- You are trying to avoid lengthy invoices and like to group as many line items as possible. This means grouping taxable and non-taxable items, which are transferred to QB as non-taxable. QB is not able to calculate the correct amount because it does not have access to the underlying itemized transactions. Refer to Invoice Template Setup for Transfer to QuickBooks.

IMPORTANT Do NOT calculate taxes in both Autotask and QB! If you have enabled Transfer Taxes Directly, we recommend that you disable the calculate Sales Tax feature in QB, or at least select a tax group that will not add taxes to the invoice (such as Out of State). Otherwise, your customers will be charged both the taxes calculated in Autotask and transferred to QB (where they appear as a line item), and the taxes QB calculates and adds to the invoice.

| Concept | Autotask | QB | Remarks |

|---|---|---|---|

| What attribute makes a billing item taxable? | Tax Category

The tax category is assigned to the Billing Code that is required for all billing item types. |

Tax Code

The tax code is assigned directly to each billing item. |

Conceptually, Tax Categories and Tax Codes are fairly similar, except in Autotask, they are assigned to billing items indirectly via the billing codes. |

| What attribute determines whether you charge tax to a customer? | Tax-Exempt Check Box

This box is part of the Organization field set. If it is selected, no tax will be charged to this customer. It overrides the tax settings of the billing items. |

Tax Code

The tax code is assigned directly to the customer. Tax codes for billing items and customers are kept on the same list. |

In Autotask, the customer is either tax-exempt or not. In QB, the ability to set up multiple tax-exempt tax codes allow you to specify a reason why no tax was charged: OOS (Out of State) or GOV (Government). |

| What determines the tax rate on a billing item? | The Total Tax Rate in the cell on the populated Tax Regions & Categories table that represents the intersection of the customer tax region and the billing item's tax category. | Tax Rate on the Sales Tax Item or the Group Rate on the Sales Tax Group. Tax Items are associated with the billing item only. | Here is where Autotask is more granular than QB. In Autotask, I can set it up so that the same billing item can not only be taxable for some customers and non-taxable for others, but the same billing item can have a different tax rate based on the tax region the customer is in. In QB, i would have to set up duplicate billing items and associate them with different tax items or tax groups to achieve the same result, but even so, I would have to be careful to select the correct billing item. |

| What attribute determines the tax jurisdiction? | Tax Region

The tax region is a geography where the same tax rules apply. The tax region is associated with the customer. |

Tax Agency

The tax agency is associated with the tax item. |

Tax Regions and Tax Agencies serve very different functions. In QB, you can specify which tax agency is owed the tax. Autotask does not associate a tax agency to a sale, since there is no functionality to remit sales tax. |

| How do you assign more than one tax to an item? | Edit Taxes per Region & Category window. Autotask lets you populate each cell in the tax table with up to 9 tax components, so you can separately show state, local, and city taxes if required. |

Tax Group

A tax group consists of several tax items. |

On the QB Invoice, the group rate is shown. On the Autotask invoice, you can show the total amount or the broken out amounts. |

| How are different tax rates applied to items on the same invoice? | Automatically.

Autotask calculates the tax rate at the line item level and totals the tax amount. |

Manually.

QB calculates the same tax rate for all taxable items on the same invoice based on the tax item associated with the customer. You have to subtotal items with a different tax amount and apply a different tax item to the subtotal to apply a different rate to some items, or create a separate invoice. |

This is a big issue if you have taxes on both products and services, but they are taxed at different rates. |

| How would I set it up if tax was owed in several states? | Create a separate Tax Region (ex. NY/NJ/CT) and configure each tax cell with tax components for all the states you owe taxes to. | Create a Tax Group with tax items for several states. | |

| Where should I calculate my taxes? | In Autotask

If all your taxes are payable to the same tax agency, and the Taxes from Autotask billing item can be mapped to this agency, Autotask provides more automation and granularity. Also, if you use Client Portal to send invoices and generally use QB to provide Accounts Receivable functionality and if you like to group items that might have different tax rates. |

In QB

If you are dealing with several tax agencies you need to remit taxes to, QB is the better option. |

What happens when you enable this setting?

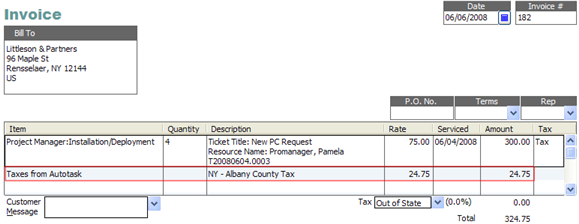

On invoices that contain taxable items, an additional item called Taxes from Autotask will be transferred to QB. The amount is equal to the sum of the taxes applied to the billing items, based on the tax region the customer is associated with, and the tax categories of the taxable items.

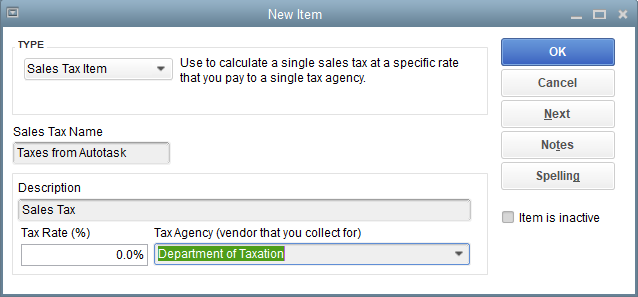

If you enable Transfer Taxes Directly, Autotask will automatically create the Taxes from Autotask item but will not be able to map it to a tax agency. Best practice is to create a Taxes from Autotask item in QB and select a tax agency before you enable the Transfer Taxes Directly setting.

How to...

- If the Sales Tax Item named Taxes from Autotask already exists, right-click and edit the item and

associate it with a valid tax agency (like a Department of Taxation). If the item does not yet exist, create it on the Item List.

- Leave the Description and Tax Rate fields blank. The Description will be populated with the name of the tax region, and the actual amount of the taxes will be transferred and added to the invoice total.

If you would like to calculate your taxes in Autotask and transfer the tax total to QB, do the following:

- Create your tax regions and categories in Left Navigation Menu > Admin > Admin Categories > Features & Settings > Finance, Accounting & Invoicing > Tax Regions & Categories. Refer to the topic on Configuring your tax table for details.

- On the Edit Organization page, select the correct tax region for each customer.

- Log into both Autotask and QB with administrator permissions.

- Go toLeft Navigation Menu > Admin > Admin Categories > Extensions & Integrations > QuickBooks Extension > Web Connectors > Edit and scroll to the bottom. Check the Transfer Taxes Directly option and save your settings.